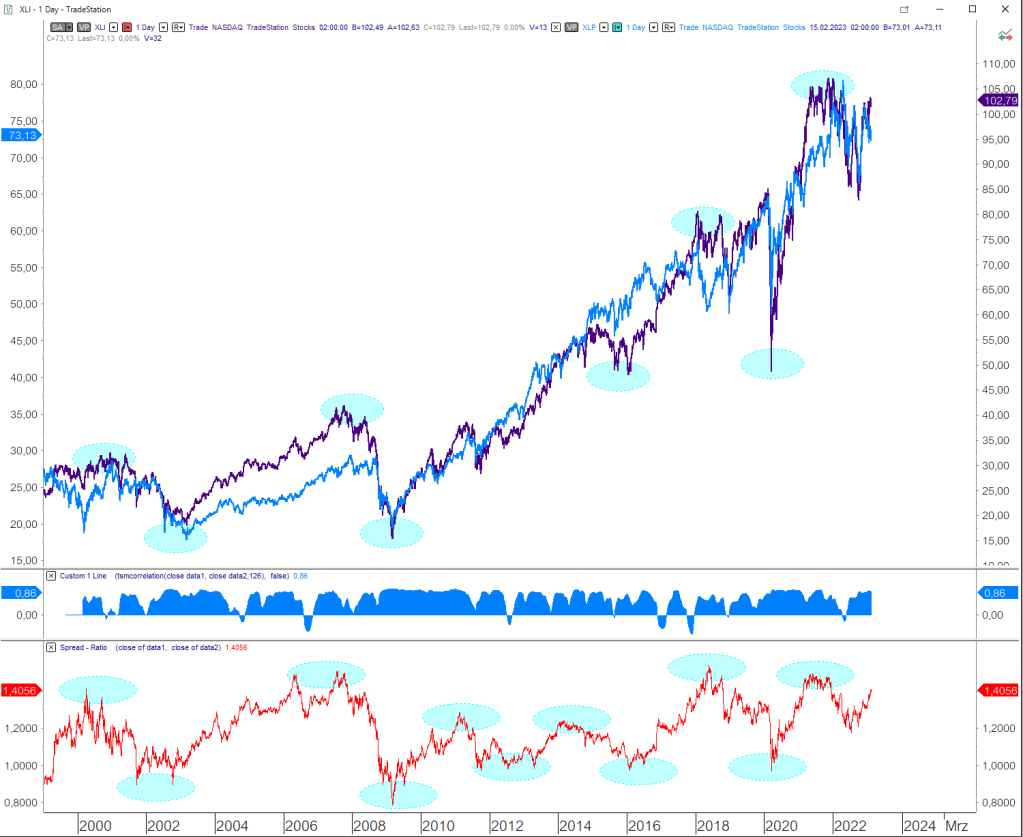

XLI vs XLP.

The ratio of the Industrial Select Sector SPDR Fund (XLI) to the Consumer Staples Select Sector SPDR Fund (XLP) is frequently used as a gauge of the stock market’s overall health and valuation.

This is why:

The XLI index measures the performance of companies in the industrial sector, which includes aerospace, defense, machinery, and transportation.

The XLP, on the other hand, tracks the performance of consumer staples companies such as food, beverages, and household goods.

The industrial sector is closely linked to economic growth and manufacturing activity, whereas the consumer staples sector is seen as more stable and defensive, with companies that provide goods and services that people need regardless of the economic climate.

When the XLI/XLP ratio rises, it indicates that investors are becoming more optimistic about economic growth and the stock market’s overall health.

This is because, during periods of economic expansion, the industrial sector tends to outperform the consumer staples sector.

When the XLI/XLP ratio falls, it indicates that investors are becoming more cautious and defensive, possibly anticipating a slowdown in economic growth or increased market volatility.

Furthermore, the XLI/XLP ratio can be used to assess stock market valuation.

When the ratio rises, it indicates that the market is becoming more expensive and overpriced, as investors are willing to pay more for shares of industrial companies than consumer staples companies.

When the ratio is lower, it indicates that the market is becoming less expensive and undervalued, as investors are willing to pay less for shares of industrial companies compared to consumer staples companies.

Overall, the XLI/XLP ratio is a useful tool for investors to monitor the health and valuation of the stock market, as well as to gain insight into changes in investor sentiment and market trends.

However, keep in mind that no single ratio or indicator can provide a comprehensive picture of the complex and ever-changing stock market.